Retirement

Eligibility

Eligible employees are Regular Full-Time, Part-Time, Part-Time less than 20 hours, Temporary employees or qualifying Seasonal employees.

To make changes to your current 401(k) contribution or to start contributing to the 401(k), please visit the American Funds website: www.myretirement.americanfunds.com to register for the first time or to log in to your existing account.

Please note: All elections must be made in American Funds by Thursday 4PM (EST) the week before the next pay date.

The King Arthur Baking Company 401(k) plan offers you the opportunity to save money for your retirement. Employee-owners may choose to participate in the 401(k) plan at American Funds with a company-matching provision – we offer both a Roth and Pretax option.

401(k) Employee Contributions:

You have the option to select a plan deferral or opt out of the 401(k) plan. If no response is received after 30 days from your date of hire, there will be an automatic enrollment into the plan with a 4% employee deferral, pre-tax. Funds will be invested in the age-appropriate Target Date fund.

IRS-Mandated 401(k) Deferral Limits:

- 2025 deferral limits: $23,500 for employee elective deferrals

- Age 50 or older catch-up contribution amount is $7,500

- 60 to 63 can contribute an additional $11,250 in 2025

Anticipated 2026 Deferral Limits:

$24,500* for employee elective deferrals and the age 50 or older catch-up contribution amount is $8,000*.

*The IRS will release 2026 Deferral limits in late October/early November 2025.

401(k) Employer Matching Contributions:

KAB will match 100% of the first $500 that you contribute to your 401(k) plan and 50% of the next $1,000. To receive the full $1,000 employer match, you must contribute at least $1,500 during the fiscal year (7/1-6/30) and be employed on the final business day of the fiscal year (6/30). The exception is for those that retire from the company which is at age 62.

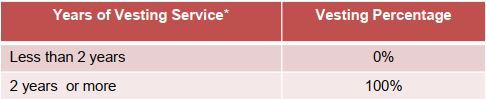

* A year of vesting means any plan year in which you work 800 hours or more.

You become 100% vested in your 401(k) account balance if you attain age 62 while employed by the Company (regardless of whether you retire then), or if you die or become totally and permanently disabled while employed by the Company.

401(K) Wednesday Webinars – Morgan Stanley

Build a strong financial future with help from Morgan Stanley’s at Work webinar series. These live education sessions deliver practical insights and tips on a broad range of topics – from personal finance and investing to life stage and community.

To register for any of these free webinars, click on this link Morgan Stanley at Work Webinars to complete the registration.

Contact Information – American Funds

Website: https://capitalgroup.retirementpartner.com/participant/#/login?accu=AmFunds

Phone: 800-204-3731

- To make elections and/or deferral changes

- To make investment allocation changes

- Fund transfers

- Fund information

- General investment questions

- Website/log-in assistance

Contact Information – Morgan Stanley

King Arthur Baking Company works closely with financial advisors at Morgan Stanley who can provide investment advisory services to employees.

You can contact a financial advisor at Morgan Stanley for:

- Investment advice and education

- Financial planning

- One-on-one meetings

Tim Meigher

Financial Advisor

(518) 427-5550

timothy.meigher@morganstanley.com

Julie Braun

Financial Advisor

(802) 652-6042

julie.braun@morganstanley.com

Chris Dubie

Financial Advisor

(802) 652-6069

chris.dubie@morganstanley.com

Forms & Documents

Annual Participant Fee Disclosure

Summary Annual Reports

Employee Stock Ownership Plan (ESOP)

The King Arthur ESOP Trust was created in June of 1996 through the generosity of owners, Frank and Brinna Sands. The Trust purchased the first 30% of Sands, Taylor & Wood Company effective 7/1/1996 and we became a 100% Employee-Owned corporation in 2004.

For those that have entered the ESOP, you may access your account on ESOPConnection:

https://www.esopconnection.com/kaf/

An ESOP is an employee-owner program that provides a company’s workforce with an interest in the company. This plan is completely company funded, there is no cost to a participant.

Eligibility

You become eligible to participate in the ESOP on the July 1st or January 1st preceding the date you complete one year of Service and are credited with at least 800 hours of Service. Your participation in the ESOP will continue until your retirement, death, disability or other termination of Service.

Once eligible, you may access your account by logging in to ESOPConnection. https://www.esopconnection.com/kaf/

ESOPConnection allows you to update beneficiary information, view your personal ESOP account information and download a PDF version of your ESOP certificate.

Vesting

The Company will make all contributions to the ESOP. You are neither required nor permitted to make contributions. Your vested interest in your account balance will depend on your number of years of Credited Service as follows:

Years of Vesting Service* Vesting Percentage

Less than 2 years 0%

2 years but less than 3 years 20%

3 years but less than 4 years 40%

4 years but less than 5 years 60%

5 years but less than 6 years 80%

6 or more years 100%

*You become 100% vested in your ESOP account balance if you attain age 62 while employed by the Company (regardless of whether you retire then), or if you die or become totally and permanently disabled while employed by the Company.

Diversification

Rules allow participants, who meet all three criteria listed below, to take a portion of their ESOP account shares and invest the proceeds in another qualified plan so as they near retirement, their investment is diversified.

- In the plan for 10 years

- Employed at KABC during the plan year at some point

- Attained at least age 55 by plan year end

In-Service Distribution

The plan allows participants who meet all three criteria listed below to distribute a portion of their ESOP account shares and invest the funds in alternative qualified plans and/or a cash distribution (tax implications). Eligibility continues until Diversification eligibility is met (age 55 and 10 years in the plan).

- Completion of 10 years in the plan

- Employed at KABC during the annual distribution window

- Attained at least age 40 by plan year end

Distribution

If employment terminates as a result of your retirement, disability or death, distribution will begin no later than the Plan Year following the Plan Year in which your employment terminates. If employment terminates for any other reason, your wait may be as many as 5 full Plan Years after the end of the Plan Year in which you leave the company before you are eligible to take your funds.

All ESOP questions can be directed to Ashley Buck: ashley.buck@kingarthurbaking.com or the Retirement Administrative Committee: RAC@kingarthurbaking.com